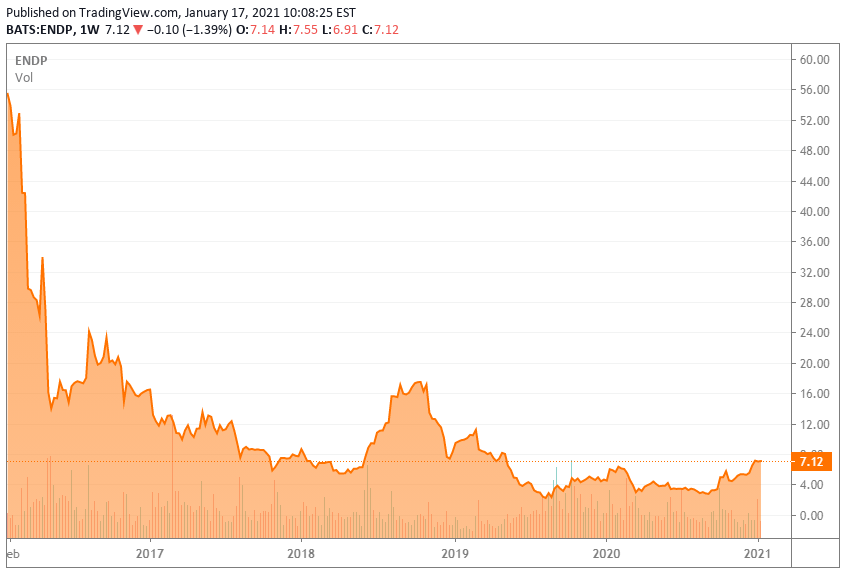

We were covering high yield bond shorts that had come down a lot and commensurately selling longs where we thought there could be at least market risk. I sold the small amount of first liens I owned in March/April. In that scenario, shareholders are wiped out. Unsecured bonds are in the teens, implying only nuisance value. Second lien bonds are now in the low 30s, implying high probability of impairment. First lien bonds are now in the high 70s, implying risk of impairment. The bond market is certainly pricing in the more dire EBITDA picture. With a net debt load exceeding $6.8 billion, I believe bankruptcy is inevitable in the situation (acknowledging that I have believed bankruptcy is inevitable, period). If that trend persists, then ENDP's new EBITDA range drops to around $450-600mm. Q2 guidance suggests the lost revenue and margin I projected for the year are going to occur in just one quarter. Just losing those profits would pressure ENDP's highly-leveraged balance sheet. In my December write up of the company, I speculated that EGRX taking 20% market share could cost ENDP $150 million of revenue and north of $100 million of EBITDA for the year. Additionally, as we approach the end of Eagle's 180-day exclusivity period in mid-July, we are preparing for potential additional market entrants."Ĭall me crazy, but that sounds like Vasostrict is likely to be feel continued pressure well into Q3 and perhaps beyond. Accordingly, we expect to see a material unfavorable impact on revenues from VASOSTRICT in the second quarter inclusive of a one-time negative destocking impact of approximately $25 million. "Based on this, we anticipate experiencing a prolonged period of VASOSTRICT vial destocking through the remainder of the second quarter. The convergence of aggressive competition and overall declining market volumes on VASOSTRICT vial demand has resulted in a current high level of VASOSTRICT vial channel inventory in terms of week on hand.

As we move through the first quarter and COVID-19-related hospital utilization began to decline, overall vasopressin market volumes also began to significantly decline. This was followed by the entry of multiple generic vasopressin vial competitors, triggered by Eagle's January launch at risk, which substantially reduced the market pricing in our VASOSTRICT vial market share. "Beginning late last year and continuing early into the first quarter of this year, hospital purchasing of VASOSTRICT vials continued to be elevated driven by COVID-19-related hospitalization utilization and projected future needs. On the conference call, the company blamed a sharp falloff in Vasostrict caused by reduced COVID hospitalizations and the entry of Eagle Pharma's ( EGRX ) competing vasopressin offering. This revenue shortfall is reverberating directly to margins with an EBITDA guide of $110mm-$125mm versus expectation of $291mm. Revenue is expected to range between $500mm and $525mm versus expectations of $649mm. The company only offers guidance one quarter out and the coming quarter is downright nasty. Unfortunately for ENDP bulls, that was the only good news from the company. Branded pharma led by Xiaflex and generics led the charge. Revenue and EBITDA were $652mm and $311mm versus consensus estimates of $628mm and $261mm respectively.

The first quarter was actually pretty good.

#Endo international stock reddit plus

I apologize for the delayed write up as I have been swamped with earnings reports plus trading the volatile markets in both equity and credit. FuzzMartin/E+ via Getty Images The QuarterĮndo International ( ENDP) reported a decent Q1 but guided to a catastrophic Q2 last Friday (May 5).

0 kommentar(er)

0 kommentar(er)